PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Nắm giữ thị trường toàn cầu trong tay bạn

Ứng dụng di động giao dịch của chúng tôi tương thích với hầu hết các thiết bị thông minh. Tải xuống Ứng dụng ngay bây giờ và bắt đầu giao dịch với PU Prime trên mọi thiết bị, mọi lúc, mọi nơi.

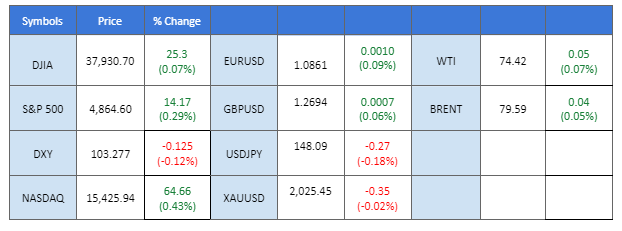

In the financial markets, the U.S. long-term treasury yield held firm above 4.1%, contributing to a slight uptick in the U.S. dollar’s value on the previous day. Investors are positioning themselves ahead of the upcoming U.S. Gross Domestic Product (GDP) release scheduled for tomorrow, with further attention on the highly anticipated U.S. Personal Consumption Expenditures (PCE) data due on Friday. In Japan, the Bank of Japan (BoJ) announced its decision to maintain the current ultra-loose monetary policy, aligning with market expectations. Notably, a hawkish statement from the BoJ governor had a positive impact on the Japanese Yen’s strength. Meanwhile, efforts by the Chinese government to address the recent stock market downturn have begun to show signs of effectiveness. The Hang Seng Index rebounded from a 15-month low, marking a second consecutive session of gains.

Current rate hike bets on 31 January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (98%) VS -25 bps (2%)

(MT4 System Time)

Source: MQL5

The Dollar Index reached a six-week peak against major currencies, reflecting investors’ anticipation of sustained positive economic data from the US this week. As the focus turns to upcoming releases, including US GDP and the US Core PCE Price Index, the dollar’s bullish momentum persists. However, lingering uncertainties prompt a cautious approach, with market participants advised to closely monitor economic indicators for nuanced trading signals.

The Dollar Index is trading higher following the prior breakout above the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 103.95, 104.70

Support level: 103.20, 102.30

Gold prices retreated amid the strengthening US Dollar, introducing uncertainties ahead of crucial economic data releases. With a lack of significant market catalysts, gold is poised to trade within a consolidative range until a breakout occurs. Investors are advised to stay vigilant, monitoring economic data closely for potential shifts that could provide clarity on the gold market’s direction.

Gold prices are trading flat while currently near the support level. MACD has illustrated diminishing bullish momentum. However, RSI is at 52, near the midline, suggesting the commodity might consolidate in a range until further catalysts in the market.

Resistance level: 2035.00, 2055.00

Support level: 2015.00, 1985.00

The Pound Sterling encountered formidable resistance near the 1.2729 level and subsequently declined as the U.S. dollar regained strength. The resurgence in the U.S. long-term treasury yield, holding steadfast above the 4.1% mark, contributed to the dollar’s renewed vigour. Looking ahead, market participants are anticipating the Bank of England’s (BoE) upcoming interest rate decision, scheduled for the following week. While widespread expectations suggest the BoE will likely maintain its current interest rate, there is growing speculation that discussions around a potential rate cut may be initiated in May.

The GBP/USD pair face strong resistance at 1.2729 but remains steady above 1.2650. The RSI has been flowing at below 50 level while the MACD is hovering near the zero line, suggesting a neutral signal for the pair.

Resistance level: 1.2729, 1.2815

Support level: 1.2630, 1.2528

The EUR/USD pair experienced a significant decline in yesterday’s trading session, setting the stage for a pivotal moment ahead of the impending European Central Bank (ECB) interest rate decision scheduled for tomorrow. Lacklustre economic data in the Eurozone has fostered expectations that the ECB may maintain its current interest rate stance, contributing to a weakening of the euro. Simultaneously, the stability observed in U.S. treasury yields provided support for the U.S. dollar, causing it to trade higher.

The EUR/USD pair eased drastically yesterday, suggesting a bearish bias for the pair. The RSI has declined to near the oversold zone while the MACD continues to flow below the zero line, suggesting the pair is trading with bearish momentum.

Resistance level: 1.0866, 1.0954

Support level: 1.0775, 1.0701

The Japanese yen experienced initial gains following the Bank of Japan’s hawkish tone on monetary policy. While maintaining its ultra-easing stance, the central bank signalled economic growth, hinting at a potential shift away from negative interest rates. Despite this indication, Governor Kazuo Ueda provided no clear timeframe, leaving investors sceptical. Consequently, the yen retraced its gains, underscoring the challenges of interpreting the central bank’s nuanced stance.

USD/JPY is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 49, suggesting the pair might extend its losses toward support level since the RSI stays below the midline.

Resistance level: 148.65, 149.50

Support level: 147.70, 146.85

After experiencing a notable downturn amid concerns over lacklustre economic performance and challenges in the property sector, the Hang Seng Index, along with other Chinese stock market indices, has witnessed a substantial rebound. The index managed to rally for two consecutive sessions, recovering from a 15-month low. The resurgence in market sentiment followed the Chinese government’s announcement of bold and comprehensive plans aimed at stabilising the stock market. While the measures have sparked a two-day rally, market participants remain cautiously optimistic and are closely monitoring developments to assess the sustainability of the recovery.

The index has gained nearly 4% for the past 2 sessions suggesting the bearish trend has eased drastically. The RSI has rebounded from the oversold zone while the MACD has crossed and is approaching the zero line from below suggesting a potential trend reversal for the index.

Resistance level: 15880, 16450

Support level: 15290, 14840

The NZD/USD pair experienced a decline, indicating a bearish outlook for the currency pair. The drop comes in the wake of the latest New Zealand Consumer Price Index (CPI) release, revealing a slight easing in inflation from the previous reading of 5.6% to the most recent figure of 4.7%. This softer inflation data has contributed to a lack of catalysts supporting the New Zealand dollar, impacting its ability to gain traction. Additionally, the strengthening U.S. dollar has exerted further pressure on the NZD/USD pair.

The NZD/USD pair is trading lower from its consolidation range, suggesting a bearish bias for the pair. However, the RSI is moving upward while the MACD is approaching the zero line from below, suggesting a bullish momentum is forming.

Resistance level: 0.6150, 0.6210

Support level: 0.6080, 0.6017

Oil prices surged as the American Petroleum Institute (API) reported a substantial 6.674 million barrel decline in US crude inventories, surpassing market expectations. This notable draw, coupled with weather-related supply disruptions, provided robust support for oil prices. As the market navigates through dynamic inventory data and supply challenges, continued monitoring is essential for investors seeking insights into the ongoing strength of oil prices.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 74.60, 78.65

Support level: 70.25, 67.40

Giao dịch ngoại hối, chỉ số, Kim loại,...với phí chênh lệch thấp trong ngành và khớp lệnh nhanh như chớp

Đăng ký Tài khoản Live PU Prime với quy trình đơn giản của chúng tôi

Dễ dàng nạp tiền vào tài khoản của bạn với nhiều kênh nạp tiền và loại tiền tệ được chấp nhận

Truy cập hàng trăm công cụ trong điều kiện giao dịch hàng đầu thị trường

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!